Profit First by Mike Michalowicz: A Fresh Way to Run Your Business Finances

Table of Contents

ToggleSharing is caring!

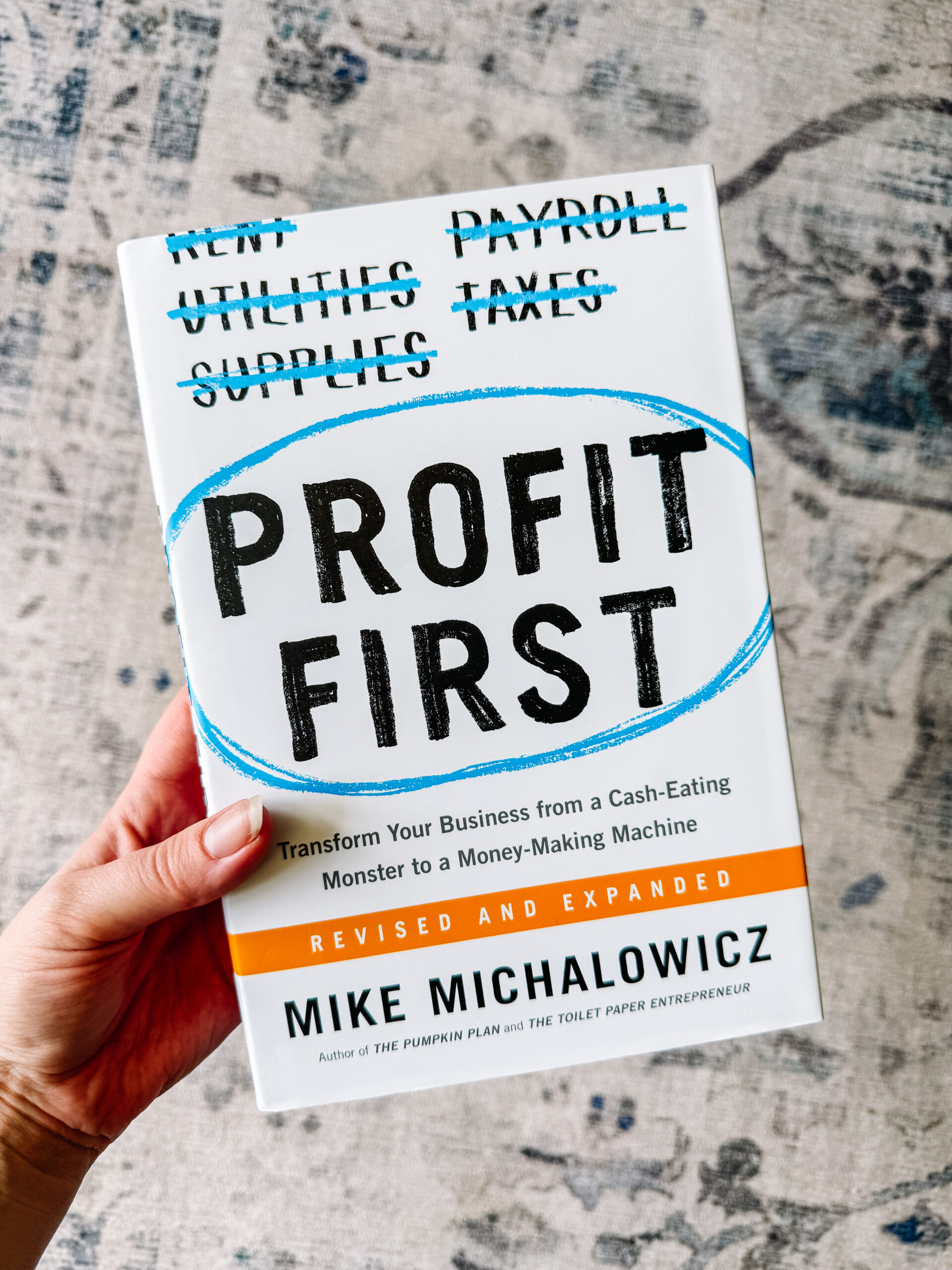

Reading Time: 3 minutesWhen I first picked up Profit First by Mike Michalowicz, I thought, “Okay, another finance book, let’s see what makes this one different.” What I didn’t expect was a total mindset shift in how I view my income, expenses, and, most importantly, my profit.

This book challenges the traditional accounting formula we’ve all been taught (Sales – Expenses = Profit) and flips it on its head:

Sales – Profit = Expenses.

This tiny switch? It’s a game changer.

On a personal note; I've read this book 2 and a half times now, so it's obviously going to be a glowing review

What Profit First Is All About

Mike Michalowicz is a serial entrepreneur who knows firsthand how it feels to have a “successful” business on paper but no money in the bank. His solution? Take your profit first, literally. This system helps business owners get out of the trap of living invoice to invoice by prioritizing profit and working smarter with what’s left over.

It’s not about working harder, it’s about managing better.

What Makes This Book So Practical

What I loved about Profit First is that it’s not just theory, it’s a step-by-step system that can be implemented quickly and simply.

The Core Concept

Mike’s main idea is that we naturally adjust to what’s available. Like using smaller plates to avoid overeating, we can use multiple bank accounts to limit our spending and better allocate money where it truly matters.

You’ll set up different accounts for things like:

- Profit

- Owner’s Pay

- Taxes

- Operating Expenses

This creates visual and emotional boundaries with your money. No more lumping everything into one big checking account and hoping it all works out.

How I’ve Started Using It

Let me be honest: setting up five bank accounts seemed excessive at first. But I started small, with just a Profit and Taxes account, and immediately felt a shift. It’s empowering to know that no matter what, I’ve already paid me and set money aside for taxes. The business gets to live off the rest.

Over time, I’ve been nudging my percentages closer to Mike’s recommendations. And surprise: it hasn’t felt limiting. It’s actually made me more creative about how I spend money in my business.

Is Profit First Worth Reading?

Absolutely. Whether you're a creative entrepreneur, coach, service provider, or e-commerce brand—it’s a powerful tool. And you don’t have to be a “numbers person” to get it.

Here’s how it stacks up:

- Clarity: Simple systems that just make sense.

- Actionable: You can start implementing before you finish reading.

- Repeatable: Once it's set up, it practically runs itself.

- Relatable: Real stories from other business owners make it feel less “finance textbook” and more “pep talk from a mentor.”

If cash flow stresses you out, or you’ve ever thought, “Where did all my money go?”, then this book is for you.

Where to Buy Profit First

You can find Profit First in multiple formats, depending on how you like to read:

- Read the Book

- Kindle

- Audiobook (Mike narrates it himself!)

Join the Book Club

Loving this conversation? Each month, I dive into a book that’s changing the way we run our businesses. Sign up below to get next month’s pick, exclusive insights, and free tools inspired by our featured reads.

And don’t forget, there’s a sister review this week at the Better Book Club by MyLifeFromHome.com with a more lifestyle focused book pick, Taste by Stanley Tucci. Perfect for balancing all those business moves with a little bit of inner calm and life.

Frequently Asked Questions (FAQ)

It’s a cash management system where you set aside profit first—then run your business on what’s left. It helps ensure your business is always profitable.

Not necessarily. You can start with just three: Income, Profit, and Expenses. As you grow more confident, you can expand.

Mike recommends every 10th and 25th of the month. This rhythm keeps you consistent and reduces financial stress.

Yes! In fact, it’s perfect for solopreneurs who need to manage money tightly and avoid feast-or-famine cycles.

Yes. Profit First doesn’t replace bookkeeping or taxes—it works alongside them to give you real-time financial clarity.

Open a dedicated Profit account and start with just 1% of your income. It’s small enough to not feel scary but impactful enough to start building momentum.

Most Popular Posts:

Sharing is caring!

PLEASE COMMENT BELOW